I hope you had a great holiday this past week, and that they were as restful as they were fun; as reflective as they were festive. And I hope you weren’t inundated with too much new clutter to add to your home.

Sometimes it’s hard to not go overboard during the holidays – after all, it’s so easy to find great stuff for your kids, and well-meaning family members often express their affection through a box and ribbon. But sometimes – it’s just all too much.

If you’re planning on joining the Sound Mind, Sound Mom Book Club this next year, and have therefore started reading Your Money or Your Life, then you might be reflecting on our consumerist culture. I have been, anyway.

When Is It Enough?

In 1929, the Herbert Hoover Committee on Recent Economic Changes published a progress report on a newly introduced concept called the “standard of living.” A new idea, this was developed soon after the Industrial Revolution in order to convince Americans that they were now working to elevate their standard of living, instead of satisfying their basic needs. Most people now had their basic needs met for adequate survival, so the government was a little concerned that Americans wouldn’t have much motivation to work. In this report, the government noted:

“..The survey proved conclusively what has long been held theoretically to be true, that wants are almost insatiable; that one want satisfied makes way for another. … economically we have a boundless field before us; that there are new wants which will make way endlessly for newer wants, as far as they are satisfied.”

In other words – as soon as people’s needs are fulfilled, they will innately turn their attention to fulfilling their wants. And wants beget newer wants; inside us is an insatiable appetite for more.

“More” is like the horizon – we can set our focus on it, but no matter how far we trek toward it, it keeps moving away. It’s a carrot strung in front of a donkey – it keeps us going, but we never win the prize. And so we keep working for the ever-elusive “more.”

Are we hard-wired that way?

C.S. Lewis refers to this appetite for more as a desire for Home. What we’re after is a complete satisfaction that we’ve “arrived,” that we are exactly where we are supposed to be. The tricky thing, however, is that we won’t find it here on earth, because we are made for another place. Our Home – heaven with our Maker – is at the core of all our desires. So until we’re there, we remain never fully satisfied.

In other words, human beings are constantly reaching for more, but more will never be enough. At least on this side of the grave.

So what are we to do?

Things are not wrong. My husband and I gifted each other iPods for Christmas, an item we’ve both wanted for years and have saved up the cash for. It was fun to treat each other to these little luxuries because we worked hard and set aside the money for them, a little at a time.

And as we drove around yesterday, we noted how iPods have morphed culturally from luxury items to near necessities – that as a couple, we are pretty behind on the times, in terms of scoring the latest and greatest gadget.

No big deal for us, but it still caused us to reflect that what historically have been luxuries only for the uber-wealthy are now at easy reach for most middle-class westerners. An endless array of entertainment is at our fingertips – we only need to beep a few buttons on some remotes to watch, listen, or play anything.

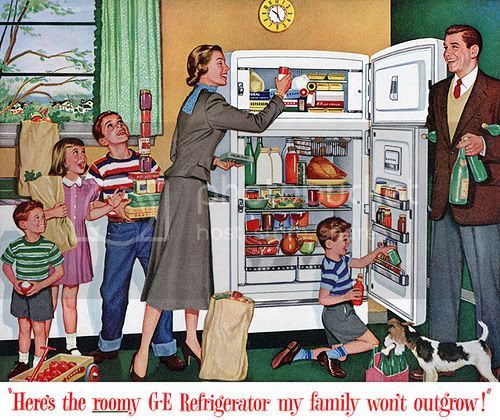

100 years ago, only the elite had ice boxes in their homes; new-fangled technology that kept blocks of ice frozen in well-insulated kitchen cabinets. Now, refrigerators are in 99.5% of American homes – it’s the most common home appliance worldwide.

Should we feel guilty?

I’m not a luddite – technology is a good thing. And I have no problem with spending money on luxuries when it can be afforded and provides a greater good.

But when is enough enough?

When are we internally at peace with our income and the things it provides? At what point do we stop mindlessly working, and start working with realistic, profitable, and healthy financial goals for our families?

What you can do at home to curb your appetite for more

Here are a few ideas to keep yourself in check as you live in a culture that’s driven on more:

1. Make a plan to regularly budget this next year. Live on what you have, and never more. I’ve written about budgeting quite a few times here and here, and some of my online friends have written excellent primers on budgeting on their blogs, such as Frugal Dad, Small Notebook, and Being Frugal. I also recommend using an easy program like Pear Budget.

2. Give. Giving – even before you budget your living expenses – is good for your soul. Make this a non-negotiable part of your money management.

3. Make friends with like-minded people. I’m not suggesting you ditch your best friend who lives on credit, but if you feel alone, seek out camaraderie and accountability. Get involved in a local church – and if you can’t find friends who want to live frugally in real life, there at least plenty of online resources. You’ll find lots of frugally-minded friends here at Simple Mom and at the sites I have listed on my links page.

4. Join the Sound Mind, Sound Mom Book Club and read our first selection, Your Money or Your Life. This book answers the basic questions behind the why of money management. Its goal is to help you create a new road map for money, to convince you that the way most of the world handles money is not only outdated, it’s unhealthy. The writers’ hope is to transform readers into “FIers” – people who are Financially Intelligent, full of Financial Integrity, and Financially Independent.

Money management is a holistic art – it affects our entire well-being and our family’s unity, not just our pocketbooks. It’s worth the effort to be good stewards of what we’re given and to be students of basic economics.

This is why we are starting with Your Money or Your Life in the 2009 Book Club. What a great way to start the year.

Care to join us? There’s plenty of time to start. All you have to do is read the book and join in our weekly discussions, which will start on January 1 (this Thursday!)- I’ve just published new information about how the Book Club will work. Feel free to read up and ask questions if you have any.

How at peace are you with your family’s income level? Does it affect the way you manage your home? And if you’ve started the book, I’d also love to hear some of your initial thoughts.

top photo source